1099 vs W-2: Employer Guide

1099 vs. W2 Employment Explained! 💼💰Подробнее

How to switch from W-2 to 1099 employment?Подробнее

Taxes III: Freelancing & 1099s | Cash Course | PragerU KidsПодробнее

Tax Tips for Musicians: Keep The Money You EarnПодробнее

2024 TurboTax Tutorial for Beginners | Complete Walk-Through | How To File Your Own TaxesПодробнее

2024 H&R Block Tutorial for Beginners | Complete Walk-Through | How To File Your Own TaxesПодробнее

How To Make Your Side Hustle 100% TAX-FREE!Подробнее

Roofers Forced to Change 1099 Sales to W2 | Top 50 Lawyer ExplainsПодробнее

1099 Contractor vs. W-2 Employee: How to Avoid Massive Tax Penalties as an EmployerПодробнее

Top 1099 Tax Deductions and Strategies for Independent ContractorsПодробнее

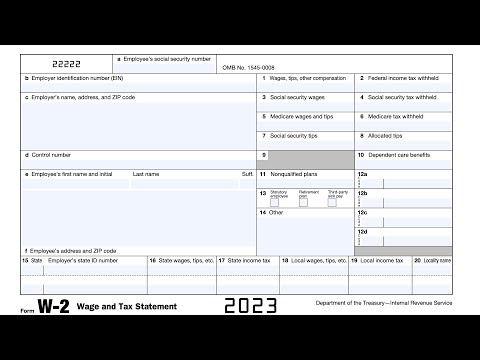

IRS Form W-2 Walkthrough (Wage and Tax Statement)Подробнее

How to Read Your W-2 Tax Form | Money InstructorПодробнее

W-2 Wage and Tax Statements: The Employer’s GuideПодробнее

1099 Contractors vs W-2 Employees - How to Classify Your WorkersПодробнее

IRS Form W2 Explained | W2 Form Walk-through | What is IRS W2 Form? 2024 Tax RefundПодробнее

Self Employment Income - 1099-NEC - TurboTaxПодробнее

Understanding S Corp Distributions: A Simple Guide for Business OwnersПодробнее

1099 Contractor to W2 Employee: Misclassification of Employees FIXEDПодробнее

How to Use Rental Losses to OFFSET W2 Taxes! [Part 1]Подробнее

![How to Use Rental Losses to OFFSET W2 Taxes! [Part 1]](https://img.youtube.com/vi/1a38vrvO-ko/0.jpg)

W2 vs 1099....Which is Actually Better for You?Подробнее