Claiming CCA on Business statements in the ProFile T1 module

Business auto in Intuit ProFile T1Подробнее

Immediate ExpensingПодробнее

ProFile: T2125 CCA FormsПодробнее

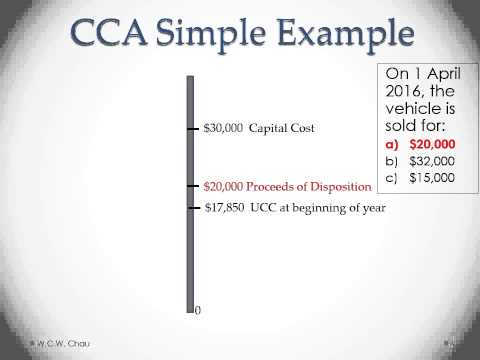

Capital Cost Allowance (Canada)Подробнее

Introduction to using the ProFile auditor in the T1 moduleПодробнее

CCA Calculation!Подробнее

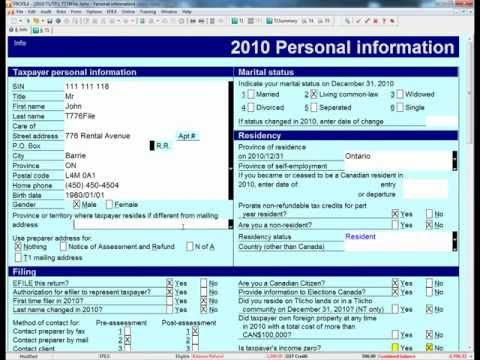

ProFile: T776 - When the CCA is not CalculatingПодробнее

CCA Calculation: UpdatedПодробнее

Calculating the Capital Cost Allowance (CCA)Подробнее

Completing the T1 Self-employed business activities in ProFileПодробнее

CCA when there is more than on form.Подробнее

Preparing T1 Returns – Reporting income and inputting T-slips on the T1 tax return (Part 2 of 5)Подробнее

How to complete the T776 tax form - Statement of Real Estate RentalsПодробнее

Uber driver: how to calculate CCA and UCC for a vehicle driven before you started rideshareПодробнее

T776 - Rental Statement - September 25, 2020Подробнее