Employment Income (part 5) - ACCA Taxation (FA 2022) TX-UK lectures

Chapter 8 Employment Income (part 5) - ACCA TX-UK Taxation (FA 2023)Подробнее

ACCA I Taxation (TX-UK) I Employment Income - TX Lecture 5Подробнее

ACCA I Taxation (TX-UK) I Self-Employment Income - TX Lecture 6Подробнее

Capital Gains Tax – Individuals – Reliefs (part 4) - ACCA Taxation (FA 2022) TX-UK lecturesПодробнее

Capital Gains Tax – Individuals – Shares (part 1) - ACCA Taxation (FA 2022) TX-UK lecturesПодробнее

Tax Adjusted Losses – Companies (part 2) - ACCA Taxation (FA 2022) TX-UK lecturesПодробнее

Capital Gains Tax – Individuals – Reliefs (part 1) - ACCA Taxation (FA 2022) TX-UK lecturesПодробнее

EMPLOYMENT INCOME (Bonus Directors) – ACCA Taxation (TX-UK) Exam FA2022 (22/23)Подробнее

Chapter 2 – Income tax computation (part 5) - ACCA TX-UK Taxation (FA 2023) lecturesПодробнее

Capital Gains Tax – Individuals (part 2) - ACCA Taxation (FA 2022) TX-UK lecturesПодробнее

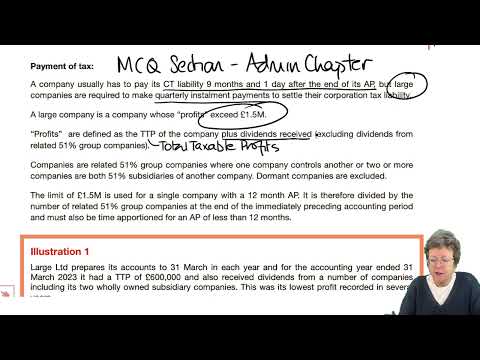

Corporation tax (part 1) - ACCA Taxation (FA 2022) TX-UK lecturesПодробнее

Inheritance Tax (part 2) - ACCA Taxation (FA 2022) TX-UK lecturesПодробнее

Capital Gains Tax – Individuals (part 5) - ACCA Taxation (FA 2022) TX-UK lecturesПодробнее

Value Added Tax – VAT (part 1) - ACCA Taxation (FA 2022) TX-UK lecturesПодробнее

Capital Gains Tax – Individuals – Reliefs (part 2)- ACCA Taxation (FA 2022) TX-UK lecturesПодробнее

Inheritance Tax (part 1) - ACCA Taxation (FA 2022) TX-UK lecturesПодробнее

Capital Gains Tax – Individuals – Shares (part 2) - ACCA Taxation (FA 2022) TX-UK lecturesПодробнее

Capital Gains Tax – Individuals (part 1) - ACCA Taxation (FA 2022) TX-UK lecturesПодробнее

Capital Gains Tax – Individuals (Part 3) - ACCA Taxation (FA 2022) TX-UK lecturesПодробнее

Employment Income (part 3) - ACCA Taxation (FA 2022) TX-UK lecturesПодробнее