Form 1099-K Walkthrough: How to report the sale of a personal item at a loss on your tax return

Form 1099-K Walkthrough: How to report the sale of a personal item at a gain on your tax returnПодробнее

Avoid IRS Penalties: Correctly Report Your 1099-KПодробнее

NEW IRS $600 TAX RULE FOR PAYPAL, CASH APP, VENMO-IRS 1099-K FORM 2024Подробнее

IRS Schedule C Walkthrough (Profit or Loss from Business)Подробнее

IRS Schedule D Walkthrough (Capital Gains and Losses)Подробнее

IRS Schedule E walkthrough (Supplemental Income & Loss)Подробнее

IRS Form 1099-K walkthrough (Payment Card & Third Party Network Transactions)Подробнее

IRS Schedule 1 Form 1040 - Line by Line Instructions & ExamplesПодробнее

The Complete Guide To Reporting Personal Items On 1099-k: Gains, Losses, And What To Do With Errors.Подробнее

Form 1099 KПодробнее

How to Best Report the New 1099-K Tax Forms for $600Подробнее

Where to report 1099-K from eBayПодробнее

$600 1099K Venmo, PayPal, Cash App What You Need to Know for 2023 Income TaxesПодробнее

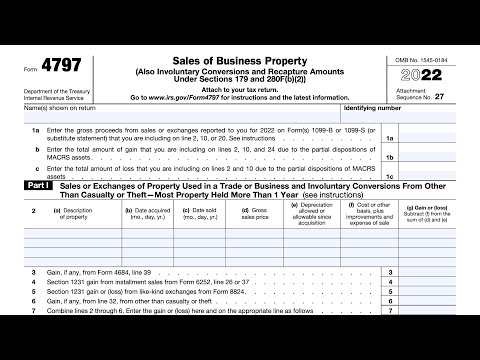

IRS Form 4797 walkthrough (Sales of Business Property)Подробнее

TurboTax Review 2023 by a CPA | Pros + Cons | Walkthrough | TutorialПодробнее

TurboTax 2022 Form 1040 - Enter Form 1099-K for Losses on Personal Use ItemsПодробнее

Where to report 1099-K from PoshmarkПодробнее

TurboTax 2022 Form 1040 - Enter Form 1099-K for GAINS on Personal Use Sale ItemsПодробнее

1099 K 101 for PhotographersПодробнее