How to Avoid Capital Gains Tax When Selling Investment Property in Australia

Should You Sell Your Investment Property Before or After Retirement?Подробнее

Sell Now - Warning to Australian Property InvestorsПодробнее

Navigating the Australian Property Market from the US | Aussie Expats | October 2024Подробнее

Should You Sell or Hold Your Property When Leaving AustraliaПодробнее

When Should You Sell Your Investment Property?Подробнее

How To Avoid Capital Gains Tax In 2024Подробнее

How Investors Use Property to Minimise Tax in AustraliaПодробнее

Selling Properties - Capital Gains Tax (CGT) - PPR 6 Year RuleПодробнее

Smart Strategies to Reduce Capital Gains Tax in Australia | Bishop Collins InsightsПодробнее

5 Tax mistakes to avoid while selling Indian properties for Australian PR/Citizens (New Budget)Подробнее

7 Tips to OPTIMISE Your Australian Tax Return in 2024Подробнее

Capital Gains On Property; Is It Better To Just Pay The Tax Or Should One Reinvest The Gains? | N18SПодробнее

12 Easy Ways To MAXIMISE Your Australian Tax Return in 2025Подробнее

CONFUSING: 2024 Capital Gains Tax (CGT) Rates when selling residential propertyПодробнее

How to Pay Zero Tax on Capital Gain for NRIs?Подробнее

Should I buy an investment property or shares?Подробнее

How to reduce capital gains tax when selling investment propertyПодробнее

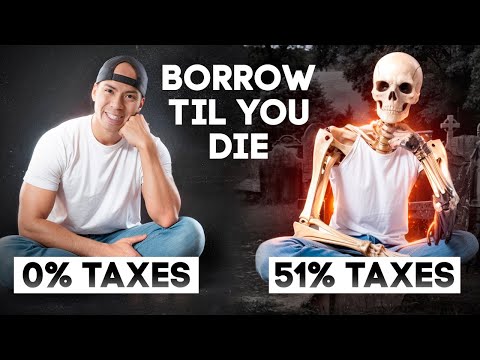

The Simple "Borrow til you Die' Tax StrategyПодробнее

How The Australian Tax System Works in 2025 (Explained in 5 Minutes)Подробнее

Tax Benefits for NRIs on the Sale of Property in India | Groww NRIПодробнее