How to Calculate TAX - A/L Economics

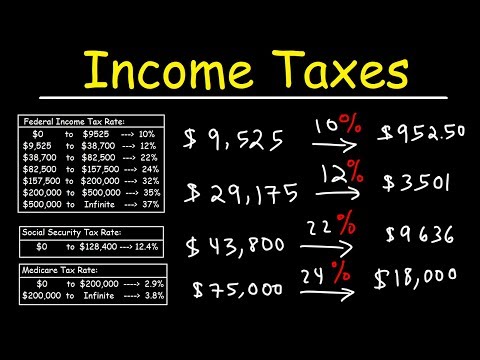

How To Calculate Federal Income Taxes - Social Security & Medicare IncludedПодробнее

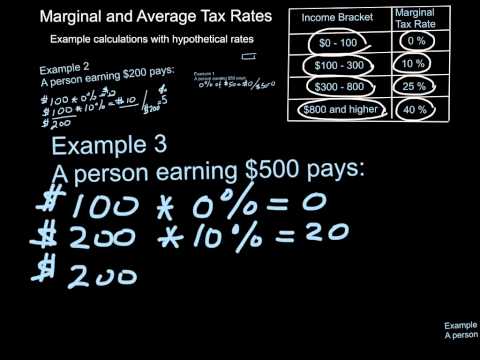

Taxation - Lesson 1.4 - Calculating Taxes - Progressive Rate StructureПодробнее

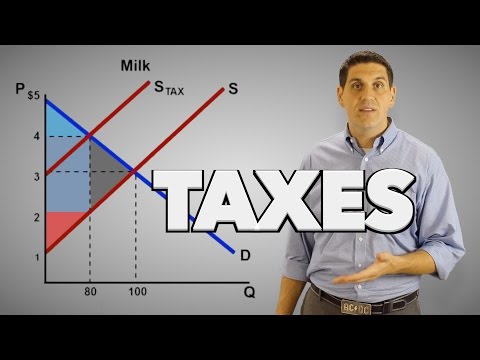

Taxes on CONSUMERS | Part 1 | Tax Revenue and Deadweight Loss of Taxation | Think EconПодробнее

Taxes on Producers- Micro Topic 2.8Подробнее

TaxesПодробнее

How to calculate Excise Tax and determine Who Bears the Burden of the TaxПодробнее

Marginal and average tax rates - example calculationПодробнее

Taxation and dead weight loss | Microeconomics | Khan AcademyПодробнее

Foundations of Economics 8.1: Taxes and WelfareПодробнее

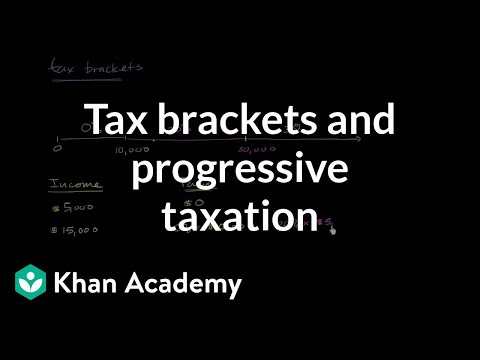

Tax brackets and progressive taxation | Taxes | Finance & Capital Markets | Khan AcademyПодробнее

Federal Income Tax: Calculating Average and Marginal Tax RatesПодробнее

Tax Model (Algebraic)Подробнее

Commodity TaxesПодробнее

equilibrium price and tax revenue after the imposition a per unit tax from Demand & Supply functionПодробнее

How to Calculate Total Tax Owed & Average Tax Rates | Economics TutoringПодробнее

Taxes: Crash Course Economics #31Подробнее

supply and demand with taxПодробнее