How to create and submit a CIS return

How To Complete The 22/23 Self Assessment Tax Return - SELF EMPLOYEDПодробнее

CIS SELF ASSESSMENT - How To Maximise Your Tax Refund 21/22Подробнее

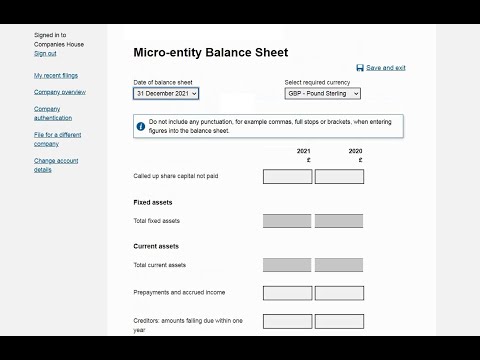

Filing your Company Accounts online - Simple Guide Updated for 2023Подробнее

The Construction Industry Scheme (CIS) - 49Подробнее

How to claim a CIS TAX REFUND in 15 minutesПодробнее

How To File Self Assessment Tax Return 💷📄Подробнее

Submitting your CIS return through Sage 50 AccountsПодробнее

How to operate the Construction Industry Scheme (CIS) using XeroПодробнее

How to Record CIS Subcontractor Payments in XeroПодробнее

M2M Technology - Eque2 Construction - How to submit your CIS ReturnПодробнее

How to submit CIS returns and verify subcontractors as an AgentПодробнее