How to enter capital losses from prior years

ITR-2/3-How to Brought Forward Past Year Losses and Carry Forward Current Year Losses IIПодробнее

How To Lodge Your Tax Return For Free With MyTax in 2024 | Step By Step Guide (Australia Tax Return)Подробнее

IRS Schedule D Walkthrough (Capital Gains and Losses)Подробнее

Capital Gain ITR2 2023-24| Set off and carry forward of losses 2023| carry forward loss next year|Подробнее

Can You Offset Capital Gains With Losses From Prior Years? - CountyOffice.orgПодробнее

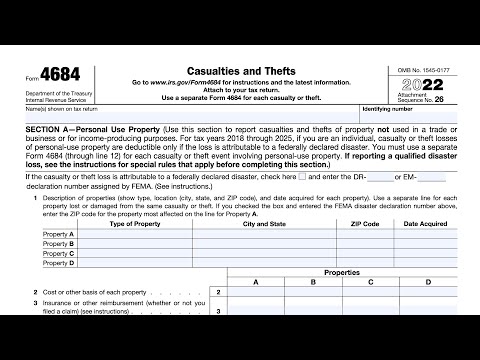

IRS Form 4684 walkthrough (Casualty & Theft Losses)Подробнее

Entering Prior Year Carryovers in 2023 Drake Tax Software: A Must-Watch Guide!Подробнее

IRS Form 6781 Walkthrough (Gains and Losses From Section 1256 Contracts and Straddles)Подробнее

Schedule D Capital Loss Carryover Worksheet Walkthrough (Lines 6 & 14)Подробнее

How request a capital loss carry backПодробнее

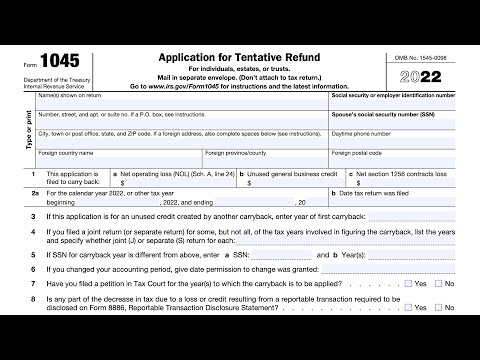

IRS Form 1045 walkthrough (Application for Tentative Refund)Подробнее

How to set-off last year loss with this year profit | Brought forward lossesПодробнее

Getting a refund from CRA when you incur a lossПодробнее

Can you deduct capital losses for income tax purposes?Подробнее

TurboTax 2022 Form 1040 - Capital Loss Carryovers on Schedule DПодробнее

How Capital Gains Tax is Calculated in AustraliaПодробнее

ETF Capital Gains in MyGov: How to Add Them Without Pre-Fill | 2024 Australian Tax ReturnПодробнее