Illinois - IL- 941 E Filing in AMS Payroll

How to USE EFTPS to Pay your Payroll Taxes on Form 941 (NEW 2023)Подробнее

How to Fill out IRS Form 941: Simple Step-by-Step InstructionsПодробнее

2017 Illinois Withholding Income Tax Changes (#1 in a series)Подробнее

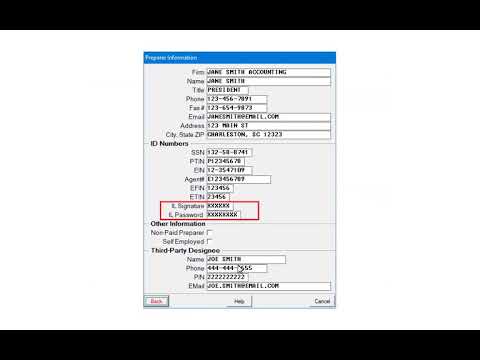

941 E-Filing InstructionsПодробнее

How to Fill Out IRS Form 941 - Simple Example for S CorporationПодробнее

How To E-file Form 941 (Online, Late, Payments, S-corp) -- EMPLOYER PAYROLL BASICS!Подробнее

A Tutorial on How To Fill Out A 941 ReportПодробнее

Illinois - State Withholding Tax Setup in AMS PayrollПодробнее

Illinois - W-2 E-Filing Using E-File DirectПодробнее

Payroll Taxes Explained: Form 941Подробнее

How to Fill Out a 941 Tax Form?Подробнее

941 Payroll Taxes: A Deep Dive Into Tax Deposit Due DatesПодробнее

How to File Illinois Form IL-1040 Tax Return for a ResidentПодробнее

Common Errors Webinar - Illinois Withholding Income TaxПодробнее

Payroll Form 941 and 941 BПодробнее

IRS Form 941-X (Amended Payroll Tax Return) - Step-by-Step ExampleПодробнее