impact of per unit tax on demand and supply

Perfect competition demand and supply analysis including impact of tax and subsidyПодробнее

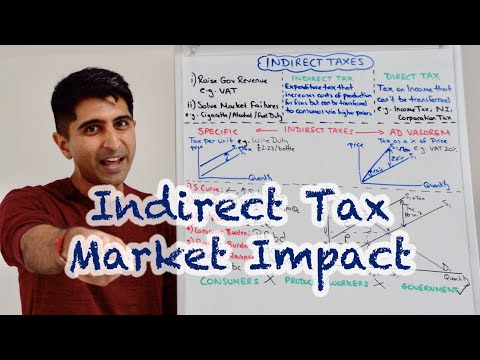

Y1 16) Indirect Tax - Full Market ImpactПодробнее

Y1 17) Indirect Tax and Elasticity (Consumer, Producer and Government Evaluation)Подробнее

Significance of PED with Indirect Taxes I A-Level EconomicsПодробнее

Finding per-unit tax that maximizes Government Tax Revenue from given demand & supply functionsПодробнее

Calculating Consumer and Producer Surplus Before and After Tax l Understanding EconomicsПодробнее

Micro 6.4 - The Effects of Government Intervention in Different Market StructuresПодробнее

How to Solve for the Per-unit Tax that Maximizes Government RevenueПодробнее

Microeconomics 1 | Perfect Competition | Unit 3, Lecture 3Подробнее

per unit tax in monopoly | optimal output MC cost is given & govt imposes a #perunittax #monopolyПодробнее

per unit tax and Tax Revenue #microeconomicsПодробнее

microeconomics perloff 2.6 eq effects of specific taxПодробнее

economic incidence of tax , govt tax revenue , deadweight loss, per unit tax on seller.Подробнее

Supply and Demand: Tax Problem with TableПодробнее

Effects of Tax on Demand and Supply Function: Numerical SolutionПодробнее

Perfect Competition (Part 5): Per Unit TaxesПодробнее

Introductory Microeconomics 27: Elasticity and Effects of a Sales TaxПодробнее

tax incidence formula from demand and supply model using ElasticitiesПодробнее

Government Intervention - Analysis Diagram for a Specific TaxПодробнее