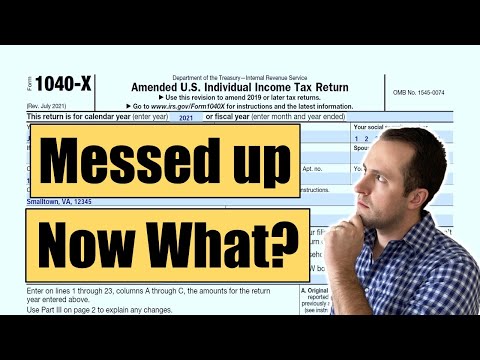

IRS Form 1040-X walkthrough (Amended U.S. Individual Income Tax Return)

IRS Form 1095-A walkthrough (Health Insurance Marketplace Statement)Подробнее

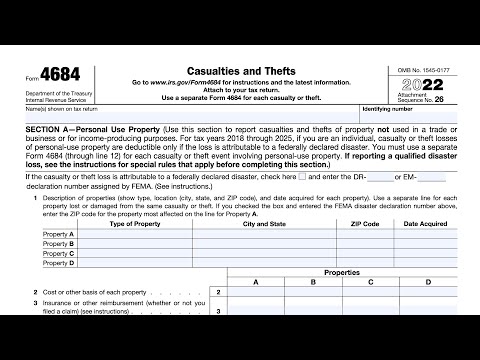

IRS Form 4684 walkthrough (Casualty & Theft Losses)Подробнее

IRS Form 1310 walkthrough (Statement of Person Claiming Refund Due a Deceased Taxpayer)Подробнее

IRS Form 9325 walkthrough (Acknowledgement & Information for Taxpayers Who File Electronic Returns)Подробнее

IRS Form 15110 walkthrough (Additional Child Tax Credit Worksheet)Подробнее

How to fill out a 1040-X Amended Tax ReturnПодробнее

Amending an Individual Tax ReturnПодробнее

IRS Form 1040-X | How to File an Amended Tax ReturnПодробнее

IRS Form 8606 (Nondeductible IRAs) walkthroughПодробнее

Direct Deposit Feature is Now Available on Amended ReturnsПодробнее

Dr. Shamroukh | #17 | How to Amend your Tax Return - Form 1040-XПодробнее

IRS Form 1040-X Line-by-Line Instructions 2024: Form 1040-X Example Fully Filled Out 🔶TAXES S3•E5Подробнее