No ITR Late fees After Due Date | Income Tax Return #itr #incometaxreturn

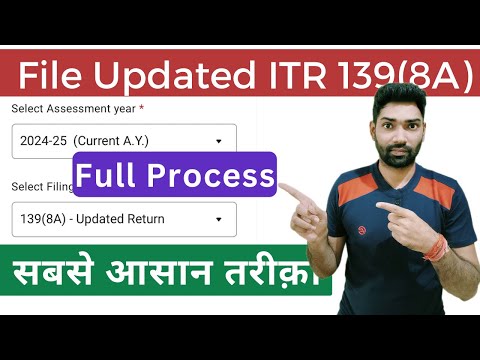

Updated Return(ITR U) filing u/s 139(8A) for 2024-25 | Updated return excel utility filing 2024-25Подробнее

Income Tax Return Filing for Old Years | Last 3 Years ITR filing | Update Return ITR-U filing NoticeПодробнее

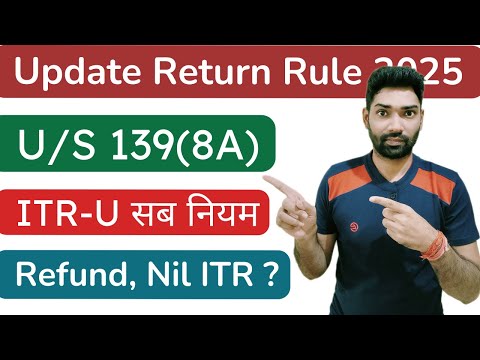

Updated return(ITR U) U/S 139(8A) New Rules 2025 | File Income tax return after due date 2024-25Подробнее

Last Date of ITR Filing | ITR Last Date | Income Tax Return Last Date | Due Date of ITR FilingПодробнее

Income Tax Return: How to File Belated ITR and Avoid Penalty & Scrutiny Before December 31Подробнее

BeLated ITR AY 2024-25 Due Date Extended | Revised ITR AY 2024-25 | ITR Last Date ExtendedПодробнее

Income Tax (Revised & Belated) Return Due Date Extended for AY 2024-25 | ITR Last Date Extended 2024Подробнее

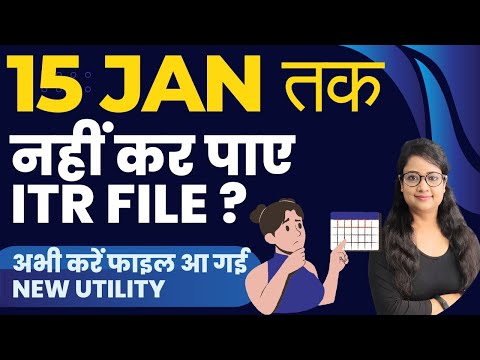

File ITR now, New ITR Utility available for AY 24-25 | ITR U (Updated Return) | How to file ITRПодробнее

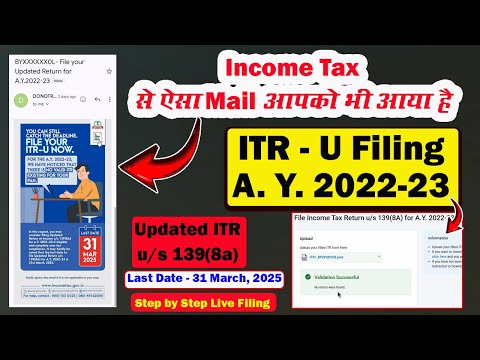

File your Updated Return for A.Y.2022-23 | File Income Tax Return For AY 2022-23 | File ITR-UПодробнее

Income Tax Return File or Revise now for FY 2023-24 & AY 2024-25 and get full refund and RebateПодробнее

Belated Return(ITR) AY 2023-24,Late fees u/s 234F कब लगेगा और कितना लगेगा Income tax return filingПодробнее

File ITR -1 Belated Before 31st December & Get Full TDS Refund and Save Late Fees #itr1Подробнее

How to file Belated ITR for AY 24-25| Belated and Revised itr filing| How to file itr after due dateПодробнее

File your Income-Tax Return for A.Y. 2024-25 Today | Higher TDS deducted but Income-Tax Return notПодробнее

Belated ITR Filing 2024-25 | Income Tax Return Filing 2024-25 | ITR Last Date AY 2024-25Подробнее

ITR Filing Online 2024-25 | Belated ITR Filing After Due Date | BeLated ITR Filing 2024-25Подробнее

File ITR - 4 Belated Before 31st December & Get Full TDS Refund and Save Late Fees #itr4Подробнее

Belated ITR Filing online 2024 25 | Last Moment पर ITR खुद से फाइल करेंПодробнее

ITR filing Online 2024-25 after due date | Belated ITR Online filing u/s 139(4) | Late fees u/s 234FПодробнее

Higher TDS deducted but Income-Tax Return not filed for AY2024-25. Kindly file your ITR before 31Подробнее