Sales returns Transaction in TallyPrime || Credit note entry in TallyPrime || Gst billing report

Case Study 2 March Month Entry Composition Dealer Accounting GST in Tally Prime | Lecture 55Подробнее

Case Study 2 February Month Entry Reverse Charge on Purchase from Unregistered Dealer | Lecture 53Подробнее

Sales invoice import excel to tally prime 4.0 | excel to tally prime data import | #tallyprime4Подробнее

gstr1 amendment in tally prime 3.0.1 | how to amendment in gstr1 tally prime 3.0.1 |Подробнее

Debit Note and Credit Note in Accounting | An in-depth overview with GST Rules & EntriesПодробнее

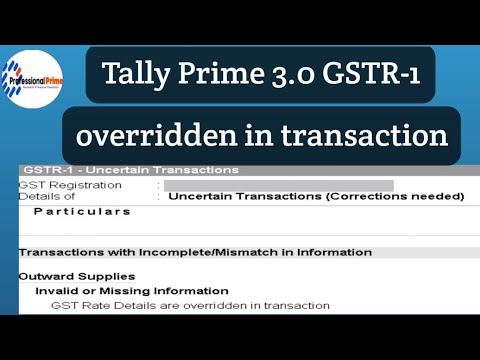

overridden in transaction in GSTR-1 Tally prime 3.0 |Подробнее

Complete Tally Prime Course | Master Tally Prime Course in Just 17 HoursПодробнее

Case Study 2 February Month Entry Purchase from Unregistered Dealer Tally Prime | Lecture 54Подробнее

New Tally Prime 4.0 | GST Details Settings in Tally Prime 4.0 | GST Returns in Tally Prime 4.0Подробнее

HOW TO RE-USE DELETE ENTRY VOUCHER NUMBER IN TALLY PRIME 3.0 | TIPS & TRICKS OF TALLYPRIME 3.0Подробнее

purchase order receipt note in tally prime | purchase order | receipt note | rejection out |Подробнее

SALES INVOICE ENTRY IN TALLY PRIME 3 0 | sales invoice ki entry tally prime 3.0 me kaise kare |Подробнее

Reconciliation of GSTR1 in tally prime | How to reconcile GSTR1 in tally primeПодробнее

Mismatch in GST Registration between the party and transaction in tally prime 3.0 |Подробнее

GST Input and Output Tax From Tally Prime | What is ITC in GST | How Show GST Tax in Tally PrimeПодробнее

tcs in tally prime | tcs entry in tally prime | tcs on sale of goods in tally prime | tcs in talllyПодробнее

Sales return entry in tally erp 9 | Sales return in tally erp 9 | sales returnПодробнее

Purchase Return And Sale Return Entry In Tally Prime | Debit Note And Credit Note In Tally PrimeПодробнее

tally prime 3.0 me JSON file kaise generate karenge | how to generate JSON file in tally prime 3.0 |Подробнее