TI BA II+: How to compute bond price on realistic (between coupons) settlement date (TIBA2-02)

TI BA II+: How to compute bond price or yield when settlement date falls on coupon date (TIBA2-03)Подробнее

FRM: TI BA II+ to price a bondПодробнее

How to Calculate the Price of a Bond using a Financial CalculatorПодробнее

How to Calculate Future Value and Present Value with BA II Plus Calculator by Texas InstrumentsПодробнее

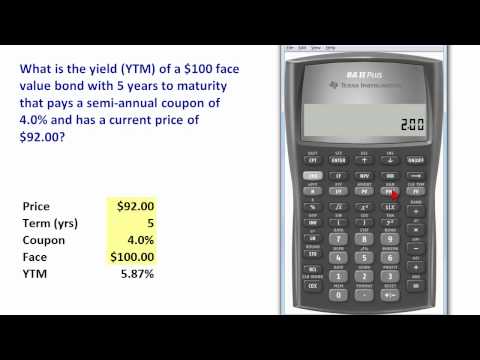

FRM: TI BA II+ to compute bond yield (YTM)Подробнее

BA II Plus bond price calculation 1Подробнее

BA II Plus Calculator Tutorial: Date FunctionПодробнее

Setting the BA II Plus to BEGIN ModeПодробнее

Calculating Bond Value (Price) | Formula | Excel | BA II Plus calculatorПодробнее

FRM: TI BA II+ to compute bond price given zero (spot) rate curveПодробнее