Use Company Losses To Get A Tax Refund

Income tax return(ITR) online filing 2024-25 small business and profession | Business itr 4 filingПодробнее

ITR 2 filing online 2024-25 | Income tax return(ITR 2) for Salary,Capital gain on Shares/Mutual FundПодробнее

Income Tax Return Date Extension? - Know the loss | ITR filing Date Extended or not? | ITR Due dateПодробнее

Income tax return filing 2024-25 issues and error on e filing portal | FM Nirmala SitharamanПодробнее

How to Maximise Your Australian Tax Return 2024Подробнее

12 Easy Ways To MAXIMISE Your Australian Tax Return in 2024Подробнее

ITR 2 filing online 2024-25 | Income tax return for capital gain/loss on share,Property,VDA,SalaryПодробнее

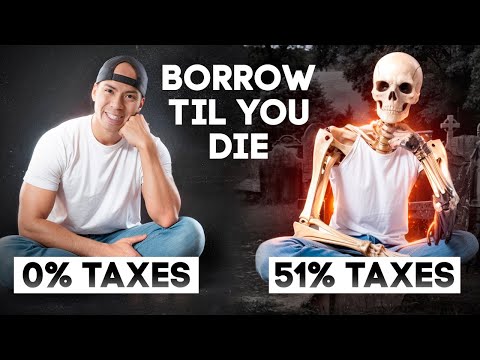

The Simple "Borrow til you Die' Tax StrategyПодробнее

Income Tax Return(ITR 3) filing online 2024 25 F&O and intraday profit/loss | Stock market tradingПодробнее

Income tax return(ITR 3) filing online 2024-25 for F&O loss,Intraday profit/loss,Capital gains/lossПодробнее

File Salary ITR in 10 mins | CA Rachana RanadeПодробнее

How To Complete The Self Assessment Tax Return For Self Employment 23/24Подробнее

10 Simple Tips to MAXIMISE Your Australian Tax Return in 2024Подробнее

How to File Income Tax Return for Online Gaming Winnings & Get TDS Refund | Section 115BBJ ExplainedПодробнее

File NIL Income Tax Return (ITR) and avoid big loss in 2024-25Подробнее

Sole Trader Tax Return: Step-by-Step Guide using MyGovПодробнее

Tax Refund 100% | Get 100% TDS Back | How to Take Fake Tax Deduction | Effects of Fake DeductionПодробнее

ACCOUNTANT EXPLAINS: How To Prepare A T2 Corporate Income Tax ReturnПодробнее

How to download reports to file your taxes?Подробнее

Income Tax on F&O Trading | F&O Loss in Income Tax Return | F&O Tax Filing & CalculationПодробнее