Who Can File Return in ITR-2 Form? | When ITR 2 Applicable? | itr 2 | itr filing online 2023-24

ITR Importance For Loan | Loan is easily available by filing ITR income tax return | EZY PAN GATEWAYПодробнее

2025 New TAX Rules | NEW TAX Vs OLD Tax with Calculator #Budget2025Подробнее

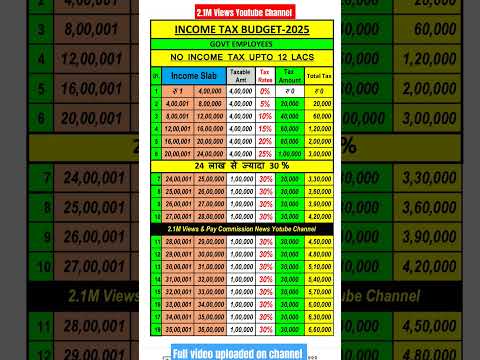

Income Tax budget 2025Подробнее

How To File ITR U (Updated ITR) Free Online After 15th January AY 2024.25 Nil ITR #itruПодробнее

Updated return(ITR U) U/S 139(8A) New Rules 2025 | File Income tax return after due date 2024-25Подробнее

File your Updated Return for A.Y.2022-23 | File Income Tax Return For AY 2022-23 | File ITR-UПодробнее

Updated Return(ITR U) filing u/s 139(8A) for 2024-25 | Updated return excel utility filing 2024-25Подробнее

Income Tax Calculation 2024-25 govt Employees #newregimeПодробнее

Income Tax Return filing date extended for updated return | No ITR required for 12 lakh?Подробнее

INCOME TAX NOTICE FOR FAKE POLITICAL PARTY DONATION 80GGC | File ITR- U now #NOTICE #incometaxnoticeПодробнее

How to file ITR1 | ITR 1 filing online | File easily ITR 1 | Who can file ITR1 | kaise file kareПодробнее

How to file Belated ITR for AY 24-25| Belated and Revised itr filing| How to file itr after due dateПодробнее

Income tax calculation new regime for govt employeesПодробнее

Higher TDS deducted but Income-Tax Return not filed for AY2024-25. Kindly file your ITR before 31Подробнее

File ITR now, New ITR Utility available for AY 24-25 | ITR U (Updated Return) | How to file ITRПодробнее

Revised Return -How to file Revised Return|ITR में mistake कैसे ठीक करें?Подробнее

Quick ITR Filing Online 2024-25 Process | For AY 2024-25? | Income Tax ReturnПодробнее

ITR 2 filling online | How to file ITR 2 | Capital Gain/Loss on Property, Share, Mutual Fund, CryptoПодробнее

Last Date of ITR Filing | ITR Last Date | Income Tax Return Last Date | Due Date of ITR FilingПодробнее

Stepwise Belated and Revised ITR Filing for AY 2024 25Подробнее