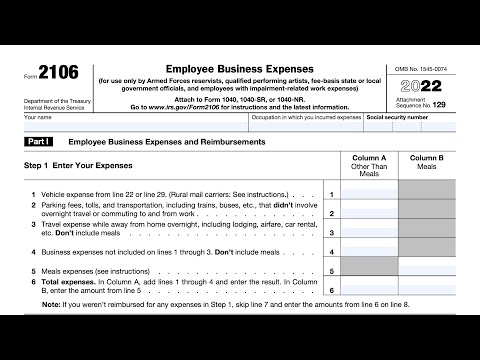

Form 2106 - Employee Business Expenses

How to Understand Your CP12E Notice (IRS found an error on your tax return. You're getting a refund)Подробнее

IRS Form W-4 walkthrough (Employee's Withholding Certificate)Подробнее

Social Security Benefits Worksheet walkthrough (IRS Form 1040, Lines 6a & 6b)Подробнее

Can I claim my expenses as miscellaneous itemized deductions on Schedule A?Подробнее

IRS Form 2106 walkthrough (Employee Business Expenses)Подробнее

Do you need to file IRS Form 2106 to claim employee business expenses?Подробнее

Student Loan Interest Deduction Worksheet Walkthrough (IRS Schedule 1, Line 21)Подробнее

What Was Form 2106-EZ: Unreimbursed Employee Business Expenses?Подробнее

Calculating Taxable Distributions & Basis in Coverdell ESAs (IRS Pub. 970 Worksheet 6-3 walkthrough)Подробнее

What Is Form 2106: Employee Business Expenses?Подробнее

IRS News -- Here’s who qualifies for the employee business expense deductionПодробнее

Use Your Car for Business Purposes?Подробнее

Form 2106 - Real Tax TalkПодробнее

How Much is the Standard Mileage Rate For 2016?Подробнее

IRS Form 4562 walkthrough (Depreciation and Amortization)Подробнее

Employee Business Expenses and Other Miscellaneous DeductionsПодробнее

Form 2106Подробнее

Who May Not Use Form 2106? | Form 2106 | Meru AccountingПодробнее

Itemized Deductions on Schedule A Explained (Module 10)Подробнее