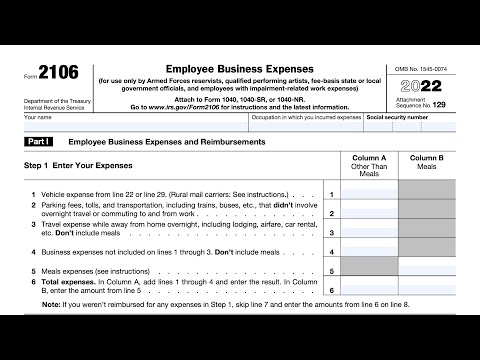

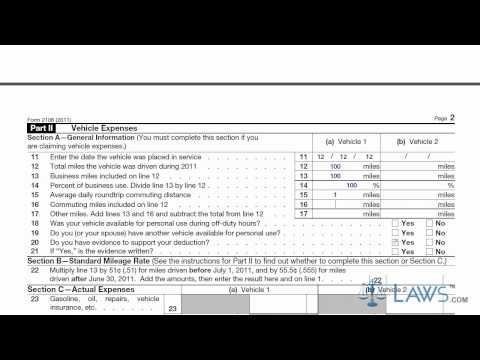

IRS Form 2106 walkthrough (Employee Business Expenses)

Calculating Taxable Distributions & Basis in Coverdell ESAs (IRS Pub. 970 Worksheet 6-3 walkthrough)Подробнее

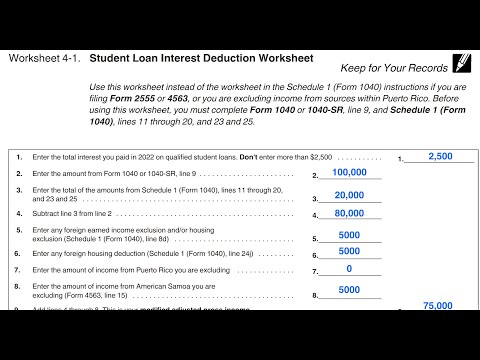

Student Loan Interest Deduction Worksheet Walkthrough (IRS Publication 970, Worksheet 4-1)Подробнее

IRS Form W-4P walkthrough (Withholding Certificate for Periodic Pension or Annuity Payments)Подробнее

IRS Form 1098-E walkthrough (Student Loan Interest Statement)Подробнее

Do you need to file IRS Form 2106 to claim employee business expenses?Подробнее

Student Loan Interest Deduction Worksheet Walkthrough (IRS Schedule 1, Line 21)Подробнее

IRA Deduction Worksheet walkthrough (Schedule 1, Line 20)Подробнее

IRS Form W-4 walkthrough (Employee's Withholding Certificate)Подробнее

Social Security Benefits Worksheet walkthrough (IRS Form 1040, Lines 6a & 6b)Подробнее

Student Loan Interest Deduction Worksheet Walkthrough (IRS Schedule 1, Line 21)Подробнее

Who May Not Use Form 2106? | Form 2106 | Meru AccountingПодробнее

Form 2106 - Employee Business ExpensesПодробнее

IRS Form 4562 walkthrough (Depreciation and Amortization)Подробнее

Learn How to Fill the Form 2106 Employee Business ExpensesПодробнее

IRS Schedule 1 walkthrough (Additional Income & Adjustments to Income)Подробнее

Form 2106Подробнее

Form 2106 - Real Tax TalkПодробнее

IRS News -- Here’s who qualifies for the employee business expense deductionПодробнее

Itemized Deductions on Schedule A Explained (Module 10)Подробнее