HOW TO FILL-OUT 2551Q QUARTERLY PERCENTAGE TAX RETURN

2024 | HOW TO FILL OUT 2551Q ON QUARTERLY BASIS [ 8%, 40 % OSD, ITEMIZED TAX RATES WHETHER BMBE OR NПодробнее

1701Q 2nd Quarterly Filing BIR Online: How to Use eBIRForms for Tax Filing [Aug 15 Deadline]Подробнее

![1701Q 2nd Quarterly Filing BIR Online: How to Use eBIRForms for Tax Filing [Aug 15 Deadline]](https://img.youtube.com/vi/nZM_2FUW4sk/0.jpg)

HOW TO FILE BIR FORM 2551Q QUARTERLY PERCENTAGE TAX SECOND QUARTER 2024Подробнее

Quarterly Percentage Tax and Income Tax for Online Sellers Gross Sales Below 250,000 Part 1Подробнее

HOW TO FILE BIR FORM 2551Q QUARTERLY PERCENTAGE TAX - SECOND QUARTER 2024Подробнее

2551Q 2nd quarter for graduated tax (new seller) - Shopee/Online sellerПодробнее

Quarterly Percentage Tax and Income Tax for Online Sellers Gross Sales Below 250,000 Part 2Подробнее

HOW TO PAY QUARTERLY PERCENTAGE TAX SECOND QUARTER 2024 THRU MYEGПодробнее

HOW TO PAY BIR 2551Q PERCENTAGE TAX USING PAYMAYA / MAYA EASY TUTORIALПодробнее

HOW TO FILE QUARTERLY PERCENTAGE TAX TNVS GRAB SECOND QUARTER 2024Подробнее

How to File 3% Percentage Tax using eBIR Forms | PAANO MAG FILE NG 3% PERCETAGE TAXПодробнее

How to Avail 8% IT Rate BIR Form 2551Q BIR Form 1701Q First Quarter 2024Подробнее

BMBE Mixed Income Earner Online Seller 3% Quarterly Percentage Tax on Gross SalesПодробнее

Quarterly Percentage Tax & Income Tax Return First Quarter 2024 Graduated IT Rates-OSD Rental IncomeПодробнее

How to File 2551-Q 2nd Quarter 2024 (Percentage Tax) for Newly Registered Business (online sellers).Подробнее

HOW TO FILE 2551Q via Ebirforms (W/ Shopee sample)Подробнее

1701Q 1st quarter 2024 + 2551Q: How to File 1701Q using eBIR OnlineПодробнее

8% Taxpayer & 2551Q Filing?! 🤔Подробнее

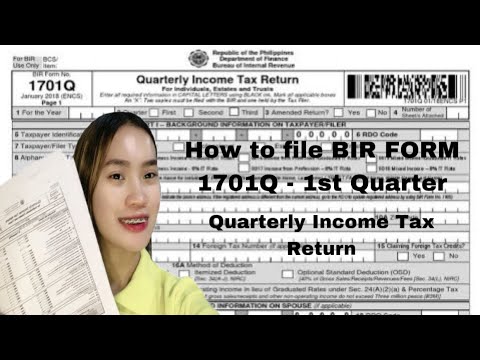

How to file BIR FORM 1701Q for 1st Quarter | Quarterly Income Tax Return 2024Подробнее

Tax Guide for Grab Driver Operator Percentage Tax BIR Form 2551Q and Income Tax 2024Подробнее