Quarterly Percentage Tax & Income Tax Return First Quarter 2024 Graduated IT Rates-OSD Rental Income

COMPARISON GRADUATED-OSD VS 8% INCOME TAX RATE PART 2Подробнее

COMPARISON GRADUATED INCOME TAX RATE WITH OPTIONAL STANDARD DEDUCTION VS 8% IT RATEПодробнее

Quarterly Percentage Tax & Income Tax Return First Quarter 2024 Graduated IT Rates-OSD Rental IncomeПодробнее

BIR FORM 1701Q QUARTERLY INCOME TAX GRADUATED RATES- ITEMIZED DEDUCTION Second Quarter 2023Подробнее

HOW TO FILE BIR FORM 2551Q QUARTERLY PERCENTAGE TAX - SECOND QUARTER 2024Подробнее

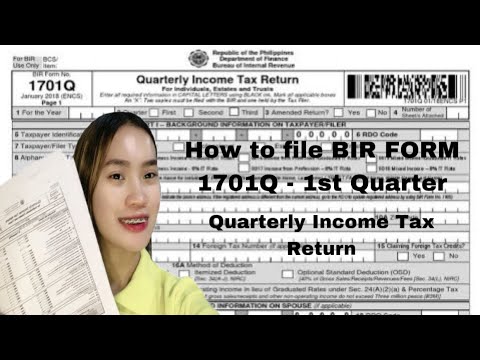

How to file BIR FORM 1701Q for 1st Quarter | Quarterly Income Tax Return 2024Подробнее

HOW TO FILL-OUT 2551Q QUARTERLY PERCENTAGE TAX RETURNПодробнее

1701Q 1st Quarter-2023(Quarterly Income Tax Return) Deadline: May 15 2023Подробнее

BIR FORM 1701Q QUARTERLY INCOME TAX FOR MIXED INCOME EARNER ITEMIZED DEDUCTIONПодробнее

1701Q 2ND Quarter-2023(Quarterly Income Tax Return) Deadline: August 15 2023 #bir #1701qПодробнее

HOW TO FILL OUT 1701Q QUARTERLY INCOME TAX RETURN E-BIR FORM 2022Подробнее

1701Q for 8% INCOME TAX OPTION 1st, 2nd & 3rd QuarterПодробнее