impact of per unit tax on supply function and tax revenue #taxrevenue #perunittax

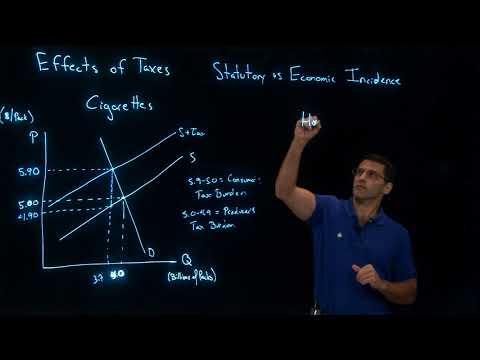

Tax Burden | Excess Tax burden and equilibrium after tax #taxburden #perunittax #taxrevenue #lseПодробнее

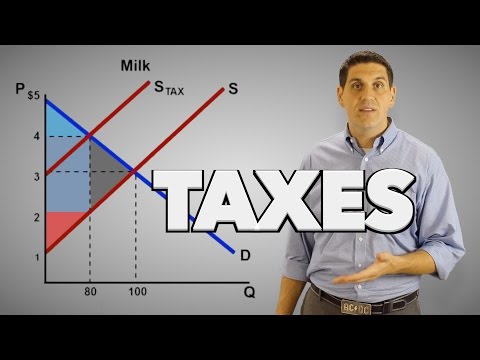

Taxes on Producers- Micro Topic 2.8Подробнее

equilibrium price and tax revenue after the imposition a per unit tax from Demand & Supply functionПодробнее

per unit tax and Tax Revenue #microeconomicsПодробнее

Per-Unit Taxes - Dont Double Count the TaxПодробнее

Taxes on PRODUCERS | Part 1 | Tax Revenue and Deadweight Loss of Taxation | Think EconПодробнее

The Effect of a Commodity Tax on SupplyПодробнее

per unit tax on supply and tax revenueПодробнее

impact of per unit tax on demand and supplyПодробнее

finding tax revenue from the imposition of per unit tax on monopolist . IIT JAM ECONOMICS QUESTIONSПодробнее

finding the the tax rate that maximizes government tax revenue from demand and supply functionПодробнее

impact of per unit tax on equilibrium price and output in perfect competition #microeconomicsПодробнее

The Economic Effect of TaxesПодробнее

supply and demand with taxПодробнее

impact of per unit subsidy on the equilibrium price & the tax revenue used to pay for the subsidyПодробнее

Taxation and dead weight loss | Microeconomics | Khan AcademyПодробнее

Taxes on CONSUMERS | Part 1 | Tax Revenue and Deadweight Loss of Taxation | Think EconПодробнее

How to Solve for the Per-unit Tax that Maximizes Government RevenueПодробнее

impact of per unit tax in Perfectly competitive Market and deadweight lossПодробнее